Air Quality Control System Market by Technology (FGD, Electrostatic Precipitators, NOx Control Systems, Scrubber & Mercury Control Systems), Pollutant Type (Gas, Dust, Multi-Pollutant), Product type, End User & Region - Global Forecast to 2029

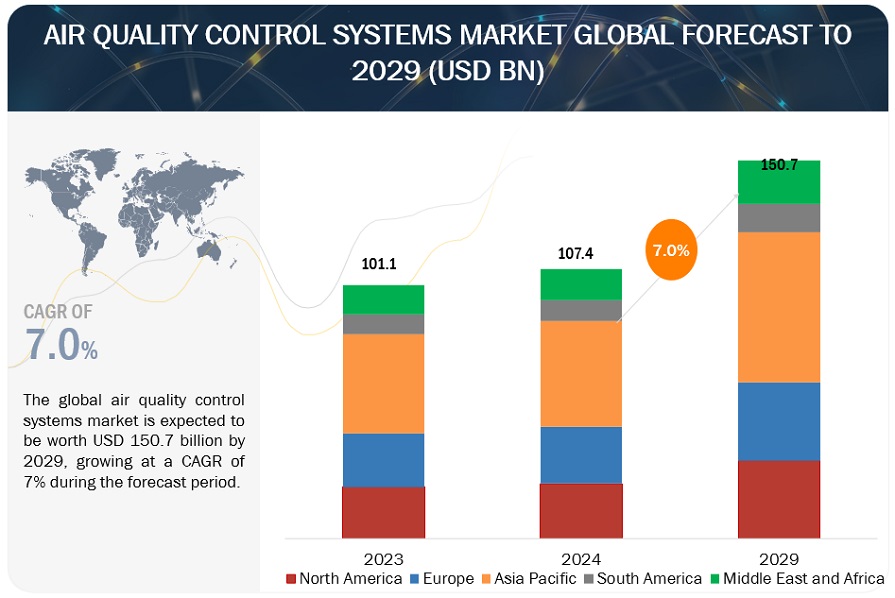

[300 Pages Report] The global Air Quality Control Systems Market is projected to reach USD 150.7 billion by 2029 from an estimated USD 107.4 billion in 2024, at a CAGR of 7.0% during the forecast period. The demand for AQCS is growing due to the increasing adoption of emission control technology, such as FGD and Nox control systems. Additionally, Advancements in AQCS technology, and the emphasis on energy efficiency contribute to the expanding demand for AQCS in various applications across residential, commercial, and industrial sectors.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Air Quality Control System market Dynamics

Driver: Increasing greenhouse gas emissions to promote air quality control systems

The escalating emissions of greenhouse gases (GHGs) are exerting significant pressure on the demand for air quality control systems. GHGs such as carbon dioxide (CO2), methane (CH4), and nitrous oxide (N2O) contribute to the greenhouse effect, trapping heat in the Earth's atmosphere and leading to global warming and climate change. The sources of these GHG emissions, including fossil fuel combustion, industrial processes, agriculture, and waste management, are major drivers of environmental degradation and air pollution.

The increasing concentration of GHGs in the atmosphere has multifaceted implications for air quality. Firstly, GHGs themselves can act as pollutants, contributing to the formation of ground-level ozone (O3) and particulate matter (PM) through photochemical reactions. Ground-level ozone is a harmful air pollutant that can cause respiratory problems, while PM, especially fine particles like PM2.5, is linked to cardiovascular and respiratory diseases. Secondly, the warming of the planet due to GHGs can exacerbate air pollution challenges. Higher temperatures can lead to increased formation of ground-level ozone and smog, especially in urban areas with high vehicular and industrial emissions. Additionally, climate change can alter weather patterns, leading to more frequent and intense heatwaves, wildfires, dust storms, and other extreme weather events, all of which can worsen air quality.

In response to these interconnected challenges, the demand for air quality control systems is on the rise. These systems play a crucial role in mitigating air pollution by capturing and reducing emissions of GHGs, criteria pollutants, and hazardous air pollutants. Advanced technologies such as catalytic converters, particulate filters, scrubbers, and emission control devices are increasingly being deployed in industries, power plants, vehicles, and other sources of emissions to minimize their environmental impact.

Government regulations and international agreements aimed at curbing GHG emissions, such as the Clean Air Act in the United States and the Paris Agreement globally, are also driving the demand for air quality control systems. Companies and industries are under increasing pressure to comply with emission standards, reduce their carbon footprint, and invest in cleaner technologies to address climate change and improve air quality.

In conclusion, the escalating emissions of greenhouse gases due to human activities are intricately linked to air quality challenges, necessitating a growing demand for air quality control systems. These systems are essential tools in the fight against air pollution and climate change, offering tangible solutions to protect public health, safeguard the environment, and achieve sustainable development goals.

Restraints:Changing trend from traditional power generation to renewable power generation

The global trend towards renewable energy is significantly impacting the air quality control system market. As industries and power plants shift from traditional fossil fuels to cleaner energy sources like solar, wind, and hydroelectric power, the need for conventional air quality control systems is decreasing. Traditionally, air quality control technologies such as scrubbers, filters, and catalytic converters have been essential for managing emissions from coal, oil, and natural gas combustion. However, renewable energy sources produce minimal to no air pollutants, thereby reducing the reliance on these systems.

According to the International Energy Agencfy (IEA), renewables accounted for nearly 30% of global electricity generation in 2020, and this share is expected to rise to 50% by 2030. This shift is driven by global initiatives to combat climate change, such as the Paris Agreement, which pushes countries towards reducing their carbon footprint. Consequently, the market for air quality control systems faces a decline in growth as the installation of renewable energy capacity expands. This transition also impacts the industrial sector, where companies are increasingly adopting renewable energy to power their operations, further reducing the demand for air quality control equipment. Moreover, regulatory policies in many countries are promoting the adoption of clean energy over traditional fossil fuels, thereby decreasing the need for extensive emission control measures.

Opportunity: Technological Advancements

Technological advancements are creating a vast opportunity landscape within the air quality control market, driving innovation, efficiency, and sustainability. One significant area of progress is the development of advanced sensors and monitoring devices. These sensors are becoming increasingly sophisticated, capable of real-time data collection, and providing precise measurements of various air pollutants such as particulate matter (PM), nitrogen oxides (NOx), sulfur dioxide (SO2), carbon monoxide (CO), and volatile organic compounds (VOCs). This level of accuracy enables better decision-making, early detection of pollution episodes, and targeted interventions to improve air quality. Furthermore, the integration of data analytics and artificial intelligence (AI) technologies is revolutionizing air quality control systems. AI algorithms can analyze vast amounts of data, identify patterns, predict trends, and optimize control strategies. This data-driven approach not only enhances the effectiveness of air quality monitoring but also enables proactive measures to be taken, such as adjusting emission levels in real time based on environmental conditions or traffic patterns. AI-powered systems can also generate actionable insights and recommendations for pollution mitigation strategies, leading to more efficient and sustainable air quality management.

Moreover, the development of innovative emission control technologies is a significant opportunity within the air quality control market. Advanced filtration systems, catalytic converters, electrostatic precipitators, and scrubbers are becoming more efficient, cost-effective, and environmentally friendly. These technologies help industries, power plants, and vehicles reduce their emissions of harmful pollutants, contributing to cleaner air and improved public health. The advent of Internet of Things (IoT) technologies is also reshaping the air quality control landscape. IoT-enabled devices and connected sensors can remotely monitor air quality parameters, automate data collection and analysis, facilitate predictive maintenance, and provide real-time alerts and notifications. This level of connectivity and automation enhances the reliability, accuracy, and efficiency of air quality control systems, making them more adaptive to dynamic environmental conditions and regulatory requirements.

Challenges: Inadequate implementation of air pollution control reforms

Governments globally are increasingly prioritizing robust air pollution monitoring networks to enhance environmental quality, a move expected to drive the growth of air quality monitoring products in the coming decade. However, the considerable costs associated with acquiring and maintaining air quality monitors hinder the full-scale implementation of environmental protection initiatives mandated by regional governments. Additionally, emerging economies, focused on fostering positive economic growth, exhibit reluctance towards adopting stringent pollution-control measures like those outlined in the Kyoto Protocol (1992). This reluctance is evident in instances where countries like China and India have been slow in enforcing stringent environmental pollution monitoring norms over the past decade.

For instance, India extended the deadline for thermal power plants to install flue gas desulphurization units, a technology aimed at reducing sulfur dioxide emissions, from 2017 to 2022 for plants near populous areas and up to 2025 for those in less-populated regions. This delay signifies a broader trend of postponements and compromises in pollution control efforts. Furthermore, the limited availability of skilled technical professionals and inadequate research and development infrastructure in emerging economies present additional hurdles for developing affordable air pollution monitoring technologies.

These factors collectively pose a significant challenge on the adoption of air quality control systems, particularly in emerging markets, impacting the market's growth trajectory during the forecast period. Addressing these barriers effectively will be crucial for accelerating the adoption of air quality control systems and fostering sustainable environmental practices globally.

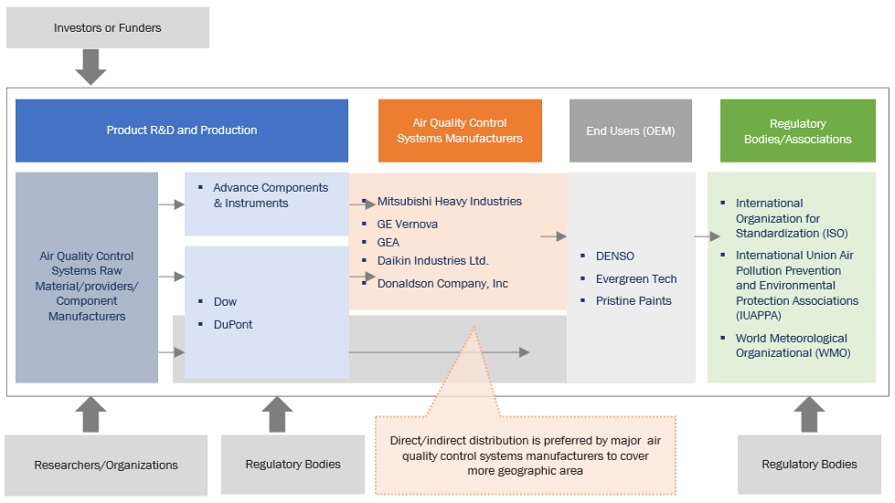

Air Quality Control System Market Ecosystem

Notable players in this industry comprise long-standing, financially robust manufacturers of AQCS Market and related components. These companies have a significant track record in the market, offering a wide range of products, employing cutting-edge technologies, and maintaining robust global sales and marketing networks. Prominent companies in this market include like Mitsubishi Heavy Industries (Japan), GE Vernova (US), GEA Group (Germany), Daikin (Japan), and Donalson (US).

Residential & Commercial, is expected to be the Second largest market, based on End User

Due to the growing use Residential and commercial installations is increasing which has products and services designed to improve indoor air quality in homes, offices, retail spaces, hospitality venues, educational institutions, and other non-industrial environments. The growth in this sector is driven by increasing urbanization, heightened awareness of the health impacts of poor indoor air quality, and the rising demand for healthier living and working conditions.

Electrostatic Precipitators, by technology, to hold the second-largest market share during the forecast period

The technology segment in the AQCS market is growing rapidly due to the global shift in clean environment which makes Electrostatic precipitators vital for removing fine particulate matter, including dust, smoke, and other airborne particles, from industrial emissions. This makes them a preferred choice in industries where fine particulate which makes the demand for Electrostatic Precipitators rise.

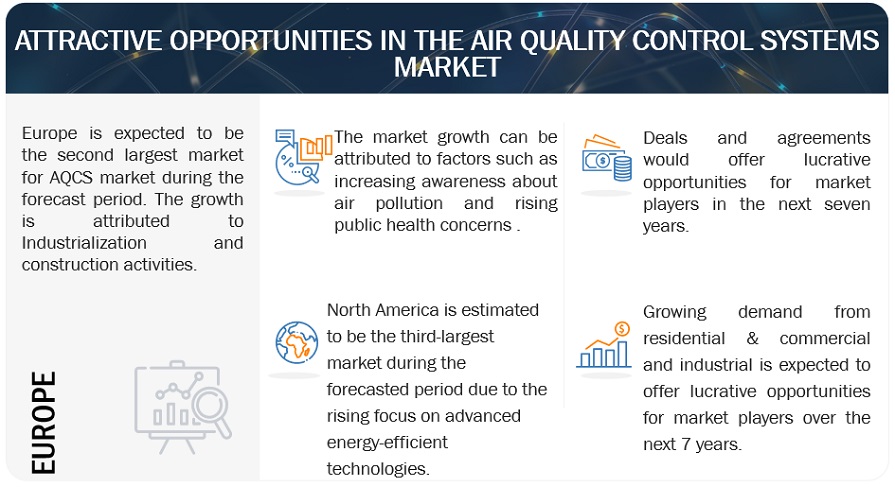

Europe is expected to account for the second-largest market during the forecast period.

The European market is being driven by a large potential market, government support (in the form of feed-in-tariff in the U.K.) and focus on emission reduction targets. In addition, European countries made a unilateral commitment in 2007, to cut the region’s greenhouse gas emissions by at least 20%. To reach this target, Europe has introduced a package of binding legislation. AQCS has been identified as one of the technologies that can assist in meeting this target. As a result, Europe has introduced various support schemes for this emerging sector. The region has a stable political environment and secure regulatory systems.

Moreover, most European Member States have implemented a range of measures to curb air pollution under the Ambient Air Quality Directives and the National Emission Reduction Commitments Directive. According to the latest reports, 70% of these initiatives are directed at the transport sector, reflecting a significant focus on reducing vehicular emissions. Meanwhile, 12% of measures target the commercial and residential energy sectors, particularly concerning domestic heating. Industrial emissions account for 8% of the initiatives, while the shipping sector is addressed by 6% of the measures. Lastly, the agricultural sector constitutes 4% of the air quality improvement efforts. These strategic allocations underscore a comprehensive approach to tackling air pollution across diverse sectors, prioritizing high-impact areas to achieve substantial reductions in key pollutants.

Key Market Players

The AQCS market is dominated by a few major players that have a wide regional presence. The major players in the AQCS market are MITSUBISHI HEAVY INDUSTRIES, LTD. (Japan) Mitsubishi Power | Air Quality Control Systems (AQCS) (mhi.com), GE Vernova (US) GE Vernova | The energy to change the world, GEA Group Aktiengesellschaft (Germany) GEA – engineering for a better world, DAIKIN INDUSTRIES, Ltd (Japan) Daikin Global | A leading air conditioning and refrigeration innovator and provider for residential,commercial and industrial applications, and Donaldson Company, Inc.Engine and Industrial Air, Oil and Liquid Filtration | Donaldson Company, Inc. (US) Between 2019 and 2023, Strategies such as product launches, contracts, agreements, partnerships, collaborations, alliances, acquisitions, and expansions are followed by these companies to capture a larger share of the AQCS market.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Market size available for years |

2021–2029 |

|

Base year considered |

2023 |

|

Forecast period |

2024–2029 |

|

Forecast units |

Value (USD) |

|

Segments covered |

Pollutant Type, Technology, Product Type, End User, and Region |

|

Geographies covered |

Asia Pacific, North America, Europe, Middle East & Africa, and South America |

|

Companies covered |

MITSUBISHI HEAVY INDUSTRIES, LTD (Japan), Babcock & Wilcox Enterprises, Inc (US), Duconenv (US), Thermax Limited (India), Testo SE & Co. KGaA (Germany), Air Spectrum Environmental Ltd (UK), Yokogawa Electric Corporation (Japan),GE Vernova (US), Doosan Power Systems India (India), Rajdeep Engineering Systems Pvt Ltd (India), GEA Group Aktiengesellschaft (Germany), ELEX AG (Schwerzenbach), Tri-Mer Corporation (US) , CompAir (US), Donaldson Company, Inc. (US), Essar Enviro Air Systems (India), APZEM Inc (India), ENVIROPOL ENGINEERS PVT. LTD. (India),Beltran Technologies, Inc. (US), Calgon Carbon Corporation (US), Daikin (), FLSmidth Cement A/S (Denmark), and EnviroAir, Inc (US) |

This research report categorizes the AQCS market by pollutant type, technology, product type, end user, and region

On the basis of Pollutant Type:

- Gas

- Dust

- Multi-Pollutant

On the basis of Technology:

- Flue gas desulphurization

- NOx Control Systems

- Mercury Control systems

- Fabric filters

- Scrubbers

On the basis of by Product type:

- Indoor

- Ambient

On the basis of by End User:

- Residential & Commercial

- Industrial

On the basis of by End User:

- Power Generation

- Cement

- Metal Processing

- Oil & Gas

- Food & Beverage

- Textile

- Pharmaceuticals

- Others

On the basis of region:

- Asia Pacific

- Europe

- North America

- Middle East & Africa

- South America

Recent Developments

- In May 2024, Mitsubishi Heavy Industries (MHI) partnered with Chiyoda Corporation to expand CO2 capture technology in Japan. MHI will license their co-developed capture process to Chiyoda, who can then offer engineering services for carbon capture projects. This collaboration leverages each company's strengths to meet decarbonization goals

- In January 2023, Donaldson Company, Inc. launched Managed Filtration Services, combining their iCue monitoring tech, industry expertise, and service network to offer condition-based maintenance and repair for industrial filtration equipment, optimizing performance and uptime.

- In March 2024, GE Vernova's AI-powered software, CERius™, is being deployed at the largest gas power plant in Cote D'Ivoire to help manage carbon emissions. This comes as regulations around emissions reporting tighten globally. CERius™ uses AI and machine learning to automate data collection, suggest emission reduction strategies, and provide standardized reporting

- In February 2021, GEA secures two orders from CEPSA for gas cleaning systems at their refineries in La Rabida and San Roque, Spain. The scope includes delivery and installation of Hot Electrostatic Precipitators (HESP) to upgrade existing FCC units, ensuring compliance with Spanish government emission limits by 2024. Commissioning is set for 2023.

Frequently Asked Questions (FAQ):

What is the current size of the Air Quality Control System market?

The current market size of global AQCS market is USD 101.12 billion in 2023.

What is the major drivers for Air Quality Control System market?

The global Air Quality Control System market is driven by Increasing investments in Environmental protection.

Which is the fastest-growing region during the forecasted period in Air Quality Control System market?

Asia Pacific is a fastest market the Asia Pacific region emerged as a notably expanding market for Air Quality Control System market.

Which is the largest segment, by Product type during the forecasted period in Air Quality Control System market?

Ambient type dominate the Air Quality Control System market by type segment due to increasing global adoption of AQCS in industries. With rising environmental awareness, government incentives, and decreasing solar panel costs, demand for Ambient AQCS is expanding rapidly.

Which is the largest segment, by Pollutant type during the forecasted period in Air Quality Control System market?

Gas Type are the most important section of the Air Quality Control System market since they are the most crucial components of power generation. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

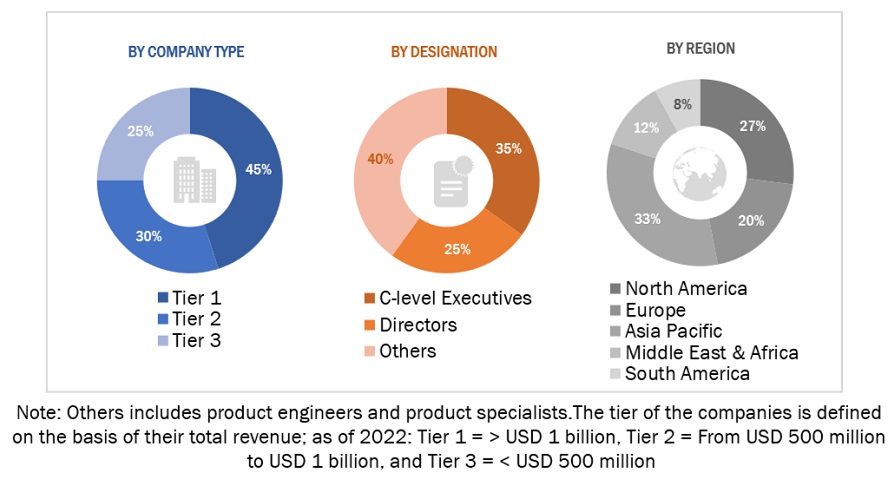

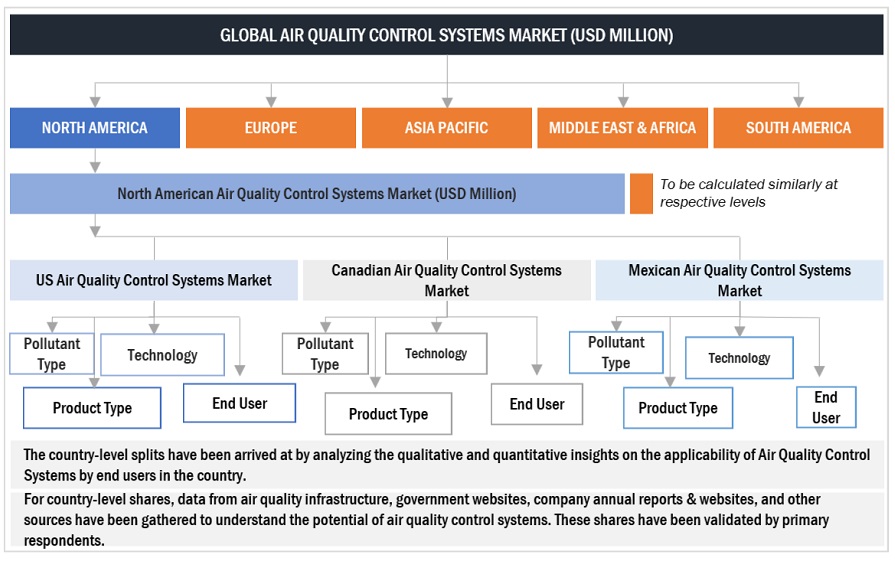

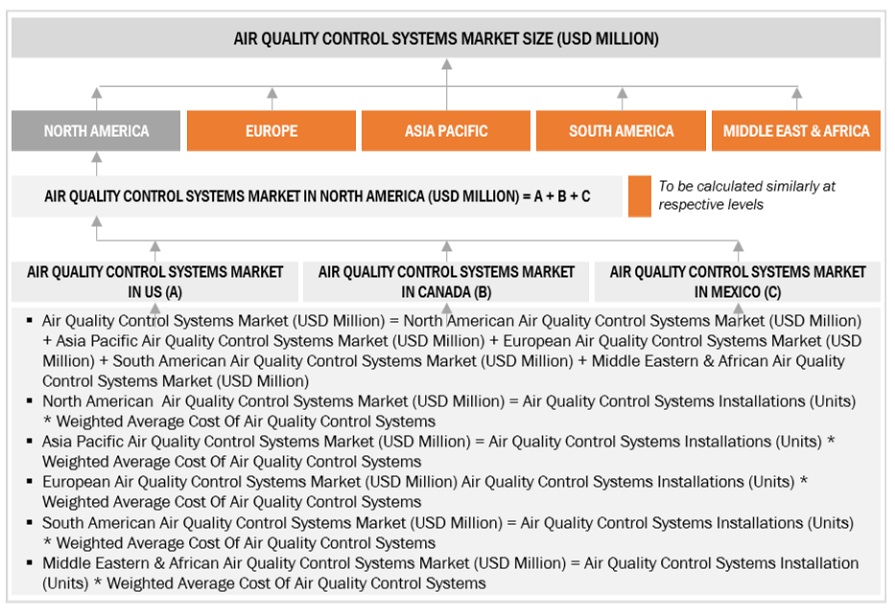

The study involved major activities in estimating the current size of the Air Quality Control System market. Exhaustive secondary research was done to collect information on the peer and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation were used to estimate the market size of the segments and subsegments.

Secondary Research

This research study on the Air Quality Control System market involved the use of extensive secondary sources, directories, and databases, such as US Department of Energy, US Environmental Protection Agency (EPA), Environment and Climate Change Canada (ECCC), Secretariat of Environment and Natural Resources (SEMARNAT), Federal Environment Agency (Umweltbundesamt - UBA), Ministry of Ecological Transition (MTE) & French Associations for Air Monitoring (AASQA), National Air Quality Cooperation Programme (NSL), Ministry of Ecology & Environment Ministry of Environment, Forest and Climate Change, Central Pollution Control Board (CPCB), National Environment Protection Council (NEPC), Ministério do Meio Ambiente (MMA) - Ministry of Environment, Brazilian Institute of Environment and Renewable Natural Resources, South African National Accreditation System (SANAS), to identify and collect information useful for a technical, market-oriented, and commercial study of the global Air Quality Control System market. The other secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, manufacturer associations, trade directories, and databases.

Primary Research

The Air Quality Control System market comprises several stakeholders such as AQCS manufacturers, manufacturers of subcomponents of AQCS, manufacturing technology providers, and technology support providers in the supply chain. An air quality control system (AQCS) is a set of technologies used to minimize the release of pollutants into the atmosphere. These systems are typically used in industrial facilities, such as power plants, factories, and refineries, to reduce emissions that can harm human health and the environment. It addresses the escalating global concerns regarding air pollution, the associated health risks of poor air quality, and the need to comply with stringent environmental regulations.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the Air Quality Control System market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and market have been identified through extensive secondary research, and their market share in the respective regions have been determined through both primary and secondary research.

- The industry’s value chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Global Air Quality Control System Market Size: Top-down Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Global Air Quality Control System Market Size: Bottom-Up Approach

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market has been split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all the segments and subsegments, the data triangulation and market breakdown processes have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand- and supply sides. Along with this, the market has been validated using both the top-down and bottom-up approaches.

Market Definition

The air quality control system market refers to the sector encompassing the production, distribution, and utilization of technologies and solutions aimed at controlling, improving and maintaining the quality of air in various environments. This market includes a wide range of products and services such as air pollution control devices, emission control systems, air purifiers, ventilation systems, and pollution control equipment utilized in industrial, commercial, and residential industry. It caters to the increasing global concern regarding air pollution, health hazards associated with poor air quality, and regulatory standards aimed at mitigating air pollutants. The market is driven by factors such as urbanization, industrialization, stringent environmental regulations, growing awareness about health impacts of air pollution, and technological advancements in air quality control solutions.

Key Stakeholders

- Air quality control system equipment manufacturers

- Air quality control system unit manufacturers

- Air quality control system unit distributors and suppliers

- Research institutes and companies.

- Hotels, hospitals, care homes, office buildings, retail stores, and other utilities

- Industry, energy, and environmental associations

- Government and research organizations

Objectives of the Study

- To define, describe, segment, and forecast the Air Quality Control System market, by pollutant type, technology, product type, and end user, in terms of value.

- To forecast the market size for five key regions: North America, South America, Europe, Asia Pacific, and Middle East & Africa, along with their key countries

- To provide detailed information about the key drivers, restraints, opportunities, and challenges influencing the growth of the market

- To strategically analyze the subsegments with respect to individual growth trends, prospects, and contributions of each segment to the overall market size

- To analyze market opportunities for stakeholders and the competitive landscape of the market

- To strategically profile the key players and comprehensively analyze their market shares and core competencies

- To analyze competitive developments, such as deals and agreements in the market

Available Customizations:

With the given market data, MarketsandMarkets offers customizations as per the client’s specific needs. The following customization options are available for this report:

Geographic Analysis

- Further breakdown of region or country-specific analysis

Company Information

- Detailed analyses and profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in Air Quality Control System Market